Contents

- 1 Introduction to Moving Accounting to the Cloud with Sage Intacct

- 2 Understanding the Benefits of Cloud Accounting

- 3 Assessing Your Accounting Needs and Readiness

- 4 Planning Your Migration to Sage Intacct

- 5 Implementing Sage Intacct

- 6 Managing Change and Overcoming Challenges

- 7 Maximizing the Value of Sage Intacct

- 8

- 9 Ensuring Compliance and Data Security

- 10 Measuring Success and ROI

- 11 Conclusion: Embracing the Future of Accounting with Sage Intacct

Introduction to Moving Accounting to the Cloud with Sage Intacct

In today’s rapidly evolving business landscape, organizations are continually seeking ways to optimize their operations, enhance efficiency, and stay competitive in an increasingly digital world. One area where significant transformation is occurring is in the realm of accounting and financial management. Traditional accounting systems, characterized by on-premises software and manual processes, are being replaced by cloud-based solutions that offer unparalleled flexibility, scalability, and accessibility.

Enter Sage Intacct, a leading cloud-based accounting software solution designed to meet the diverse needs of modern businesses. Sage Intacct provides a comprehensive suite of features and functionalities that empower organizations to streamline their accounting processes, gain real-time visibility into financial data, and make informed decisions that drive growth and profitability.

The transition to cloud-based accounting with Sage Intacct represents more than just a technological upgrade—it signifies a fundamental shift in how organizations approach financial management. By harnessing the power of the cloud, businesses can unlock a wealth of benefits, including:

Cost-effectiveness:

Cloud-based solutions eliminate the need for costly hardware infrastructure and ongoing maintenance expenses associated with traditional on-premises systems. With Sage Intacct, organizations can enjoy predictable subscription-based pricing models that scale with their business needs.

Enhanced accessibility and flexibility:

Cloud-based accounting allows users to access financial data anytime, anywhere, and from any device with an internet connection. This level of accessibility enables remote work, facilitates collaboration among distributed teams, and empowers decision-makers to stay informed even while on the go.

Improved scalability:

Sage Intacct’s cloud architecture is designed to scale seamlessly as organizations grow and evolve. Whether expanding into new markets, adding new product lines, or accommodating fluctuations in transaction volume, Sage Intacct can adapt to meet changing business requirements without disruption.

Advanced security and data protection:

Sage Intacct employs robust security protocols and encryption measures to safeguard sensitive financial data against unauthorized access, data breaches, and cyber threats. With built-in compliance features and regular security updates, organizations can trust that their data is protected at all times.

As organizations navigate the complexities of today’s business environment, the decision to transition accounting processes to the cloud with Sage Intacct represents a strategic investment in the future. By embracing cloud-based accounting solutions, businesses can gain a competitive edge, drive operational efficiency, and position themselves for long-term success in a dynamic and ever-changing marketplace.

In the sections that follow, we will delve deeper into the benefits of cloud accounting, explore the considerations involved in migrating to Sage Intacct, and provide practical guidance on how organizations can maximize the value of this powerful platform. Join us as we embark on a journey to unlock the full potential of cloud-based accounting with Sage Intacct.

Understanding the Benefits of Cloud Accounting

In the realm of modern business, the move to cloud-based accounting solutions has become a strategic imperative for organizations seeking to optimize their financial management practices. As we explore the profound advantages offered by cloud accounting, with a specific focus on Sage Intacct, it becomes evident that this shift goes beyond mere technological adoption—it is a transformative journey that redefines the way businesses operate and make financial decisions.

Cost-Effectiveness:

The traditional capital expenses associated with on-premises accounting systems, such as hardware purchases and maintenance, are replaced by a more predictable and scalable subscription-based model. Sage Intacct’s cloud architecture eliminates the need for organizations to invest in costly infrastructure, allowing them to redirect resources toward strategic initiatives and business growth.

Enhanced Accessibility and Flexibility:

Cloud-based accounting liberates financial data from physical constraints, enabling users to access critical information from any location with an internet connection. Sage Intacct’s mobile-friendly design facilitates remote work, empowering finance teams, executives, and stakeholders to collaborate seamlessly regardless of geographical boundaries.

Improved Scalability:

Sage Intacct’s cloud-native design ensures scalability that aligns with the dynamic nature of businesses. As organizations expand or experience fluctuations in transaction volume, Sage Intacct can effortlessly scale to meet evolving needs.

The ability to adapt to changing business requirements positions organizations for growth without the constraints associated with traditional accounting systems.

Advanced Security and Data Protection:

Sage Intacct prioritizes the security of financial data, employing robust encryption, authentication, and authorization measures to safeguard against unauthorized access and cyber threats. Continuous monitoring, regular security updates, and adherence to compliance standards contribute to a secure cloud environment that instills confidence in the confidentiality and integrity of financial information.

Real-Time Collaboration and Data Insights:

Sage Intacct’s cloud-based platform facilitates real-time collaboration among team members, enabling seamless communication and data sharing. The availability of up-to-date financial data allows for informed decision-making, as stakeholders access insights and reports in real time, fostering agility and responsiveness to market dynamics.

Streamlined Integration and Automation:

Cloud accounting with Sage Intacct enables effortless integration with other business applications, creating a cohesive ecosystem where financial data flows seamlessly. Automation features within Sage Intacct streamline routine tasks, reduce manual errors, and enhance overall operational efficiency, freeing up valuable time for strategic financial analysis.

The adoption of cloud accounting, particularly with Sage Intacct, transcends a mere technological upgrade—it represents a strategic shift towards a more agile, efficient, and scalable financial management paradigm. In the subsequent sections, we will delve into the practical aspects of assessing organizational needs, planning a migration to Sage Intacct, and implementing this powerful cloud-based accounting solution to realize its full potential. Join us on this transformative journey as we unlock the myriad benefits of cloud accounting with Sage Intacct.

Assessing Your Accounting Needs and Readiness

Transitioning to cloud-based accounting with Sage Intacct requires a thorough assessment of your organization’s current accounting practices, technological infrastructure, and readiness for digital transformation. By conducting a comprehensive evaluation, you can identify areas of improvement, set realistic goals, and lay the groundwork for a successful migration to the cloud.

Evaluating Current Accounting Systems and Processes:

Assess the functionality and effectiveness of existing accounting software and processes.

Identify pain points, inefficiencies, and areas where automation or streamlining is needed.

Consider feedback from key stakeholders, including finance teams, executives, and end-users, to gain insights into usability and functionality requirements.

Identifying Pain Points and Areas for Improvement:

Review feedback and insights gathered from stakeholders to identify pain points and areas for improvement in current accounting systems and processes. Consider factors such as data accuracy, reporting capabilities, and ease of use when assessing the effectiveness of existing systems. Determine specific challenges or bottlenecks that may hinder productivity or impede financial visibility.

Assessing the Organization’s Readiness for Cloud Migration:

Evaluate the organization’s technological infrastructure and readiness for cloud adoption. Consider factors such as network bandwidth, data security protocols, and staff training needs. Assess the organization’s culture and readiness for change, recognizing potential resistance to cloud adoption and addressing concerns proactively.

Establishing Goals and Objectives for the Transition:

Define clear goals and objectives for the transition to cloud-based accounting with Sage Intacct. Set measurable targets for improved efficiency, accuracy, and accessibility of financial data. Align goals with broader organizational objectives, such as improving decision-making, reducing costs, or enhancing regulatory compliance.

By conducting a thorough assessment of your accounting needs and readiness for cloud migration, you can lay a solid foundation for a successful transition to Sage Intacct. This proactive approach enables you to identify potential challenges, mitigate risks, and align your objectives with the capabilities of Sage Intacct’s cloud-based accounting solution. In the subsequent sections, we will explore practical strategies for planning and executing a smooth migration to Sage Intacct, ensuring that your organization maximizes the benefits of cloud-based accounting.

Planning Your Migration to Sage Intacct

Planning the migration to Sage Intacct is a critical phase that requires careful consideration of various factors, including data integrity, stakeholder engagement, and resource allocation. By developing a comprehensive migration plan, organizations can minimize disruption, mitigate risks, and ensure a seamless transition to the cloud-based accounting platform.

Conducting a Comprehensive Data Audit and Cleanup:

Assess the quality and integrity of existing financial data to identify inconsistencies, errors, and duplicates.

Develop a data cleanup plan to rectify any discrepancies and ensure that data migrated to Sage Intacct is accurate and reliable.

Establish data migration protocols and timelines to ensure a smooth transition without compromising data integrity.

Identifying Key Stakeholders and Forming a Migration Team:

Identify key stakeholders, including finance leaders, IT personnel, and end-users, who will play a role in the migration process.

Form a dedicated migration team comprising individuals with expertise in accounting, technology, project management, and change management. Foster open communication and collaboration among team members to facilitate a coordinated and efficient migration effort.

Developing a Timeline and Migration Plan:

Create a detailed timeline that outlines key milestones, deadlines, and dependencies for the migration project.

Break down the migration process into manageable phases, such as data preparation, system configuration, user training, and post-migration support. Allocate resources and budgetary considerations to each phase of the migration plan to ensure that objectives are met within predefined timelines and budget constraints.

Budgeting for Implementation Costs and Training Expenses:

Estimate implementation costs associated with licensing fees, software customization, data migration, and technical support. Budget for training expenses to ensure that end-users are equipped with the knowledge and skills needed to effectively utilize Sage Intacct. Consider potential hidden costs, such as downtime, productivity loss, and additional resources required during the transition period.

By meticulously planning the migration to Sage Intacct, organizations can mitigate risks, minimize disruptions, and maximize the benefits of transitioning to a cloud-based accounting platform. A well-defined migration plan ensures that stakeholders are aligned, resources are allocated efficiently, and potential challenges are addressed proactively. In the subsequent sections, we will delve into the practical aspects of implementing Sage Intacct, including customization, data migration, training, and testing, to ensure a successful transition to the cloud-based accounting solution.

Implementing Sage Intacct

Implementing Sage Intacct is a pivotal phase in the migration process, requiring careful planning, configuration, and training to ensure a smooth transition and successful adoption by users. By following best practices and leveraging Sage Intacct’s robust features, organizations can optimize their accounting workflows, streamline processes, and unlock the full potential of the cloud-based platform.

Customizing Sage Intacct to Align with Organizational Needs and Workflows:

Collaborate with key stakeholders to define requirements and customize Sage Intacct to meet specific business needs and workflows.

Configure chart of accounts, financial reporting structures, and user permissions to reflect organizational hierarchies and reporting requirements. Leverage Sage Intacct’s flexible customization options to tailor the platform to unique business processes and preferences.

Importing Data and Configuring Settings:

Develop a data migration strategy that prioritizes data accuracy, completeness, and consistency.

Utilize data import tools and templates provided by Sage Intacct to streamline the migration process and minimize manual data entry. Configure system settings, preferences, and integrations to optimize Sage Intacct’s performance and compatibility with existing business applications.

Training Staff on How to Use Sage Intacct Effectively:

Provide comprehensive training and support to end-users to ensure they are proficient in navigating Sage Intacct and performing key accounting tasks. Offer role-specific training sessions tailored to the needs of finance professionals, administrators, and other users who will interact with the platform. Utilize online tutorials, user guides, and interactive training modules provided by Sage Intacct to facilitate learning and skill development.

Testing the System and Conducting Quality Assurance Checks:

Conduct rigorous testing of Sage Intacct’s functionality, data integrity, and user experience to identify any issues or discrepancies. Develop test scenarios and use cases to validate system configurations, workflows, and integration points. Collaborate with end-users to gather feedback and address any concerns or issues identified during the testing phase.

By implementing Sage Intacct effectively, organizations can optimize their accounting processes, improve data accuracy and reliability, and enhance decision-making capabilities.

A well-executed implementation lays the foundation for long-term success and ensures that organizations derive maximum value from their investment in Sage Intacct’s cloud-based accounting solution. In the subsequent sections, we will explore strategies for managing change, overcoming challenges, and maximizing the value of Sage Intacct in the context of organizational operations and financial management.

Managing Change and Overcoming Challenges

As organizations transition to Sage Intacct and embrace cloud-based accounting, they may encounter various challenges and resistance to change. Effective change management strategies are essential to navigate these obstacles, foster user adoption, and ensure a successful transition to the new accounting platform.

Communicating the Benefits of Sage Intacct to Stakeholders:

Develop a clear and compelling message that highlights the benefits and value proposition of Sage Intacct for stakeholders at all levels of the organization. Emphasize how Sage Intacct addresses pain points, streamlines processes, and enhances decision-making capabilities to garner support and buy-in from key stakeholders.

Addressing Resistance to Change and Overcoming Adoption Barriers:

Identify and acknowledge concerns or resistance to change among end-users, managers, and other stakeholders.

Provide opportunities for open dialogue and feedback to address misconceptions, alleviate fears, and build confidence in the new accounting platform. Offer training, support, and resources to empower users to embrace change and adapt to new ways of working with Sage Intacct.

Providing Ongoing Support and Training for Users:

Establish a support infrastructure, including helpdesk services, user forums, and knowledge bases, to address user inquiries, issues, and technical challenges. Offer continuous training and professional development opportunities to help users build confidence and proficiency in using Sage Intacct effectively. Foster a culture of learning and collaboration where users feel empowered to explore new features, share best practices, and seek assistance when needed.

Monitoring Performance and Addressing Issues Proactively:

Establish key performance indicators (KPIs) and metrics to track user adoption, system usage, and overall satisfaction with Sage Intacct. Implement regular feedback mechanisms, such as surveys, focus groups, and user feedback sessions, to gather insights and identify areas for improvement. Proactively address issues, challenges, and user pain points to maintain momentum, drive engagement, and ensure the long-term success of the Sage Intacct implementation.

By effectively managing change and addressing adoption challenges, organizations can maximize the benefits of Sage Intacct, drive user engagement, and achieve their strategic objectives. A proactive and collaborative approach to change management fosters a culture of innovation, resilience, and continuous improvement, positioning organizations for success in the dynamic and evolving landscape of cloud-based accounting. In the subsequent sections, we will explore strategies for maximizing the value of Sage Intacct, ensuring compliance and data security, and measuring success and return on investment (ROI) in the context of cloud accounting.

Maximizing the Value of Sage Intacct

Once Sage Intacct is successfully implemented, organizations can focus on maximizing its value by leveraging advanced features, optimizing workflows, and driving continuous improvement in financial management processes. By harnessing the full capabilities of Sage Intacct, organizations can streamline operations, gain deeper insights into financial performance, and drive strategic decision-making.

Leveraging Advanced Features and Integrations for Enhanced Functionality:

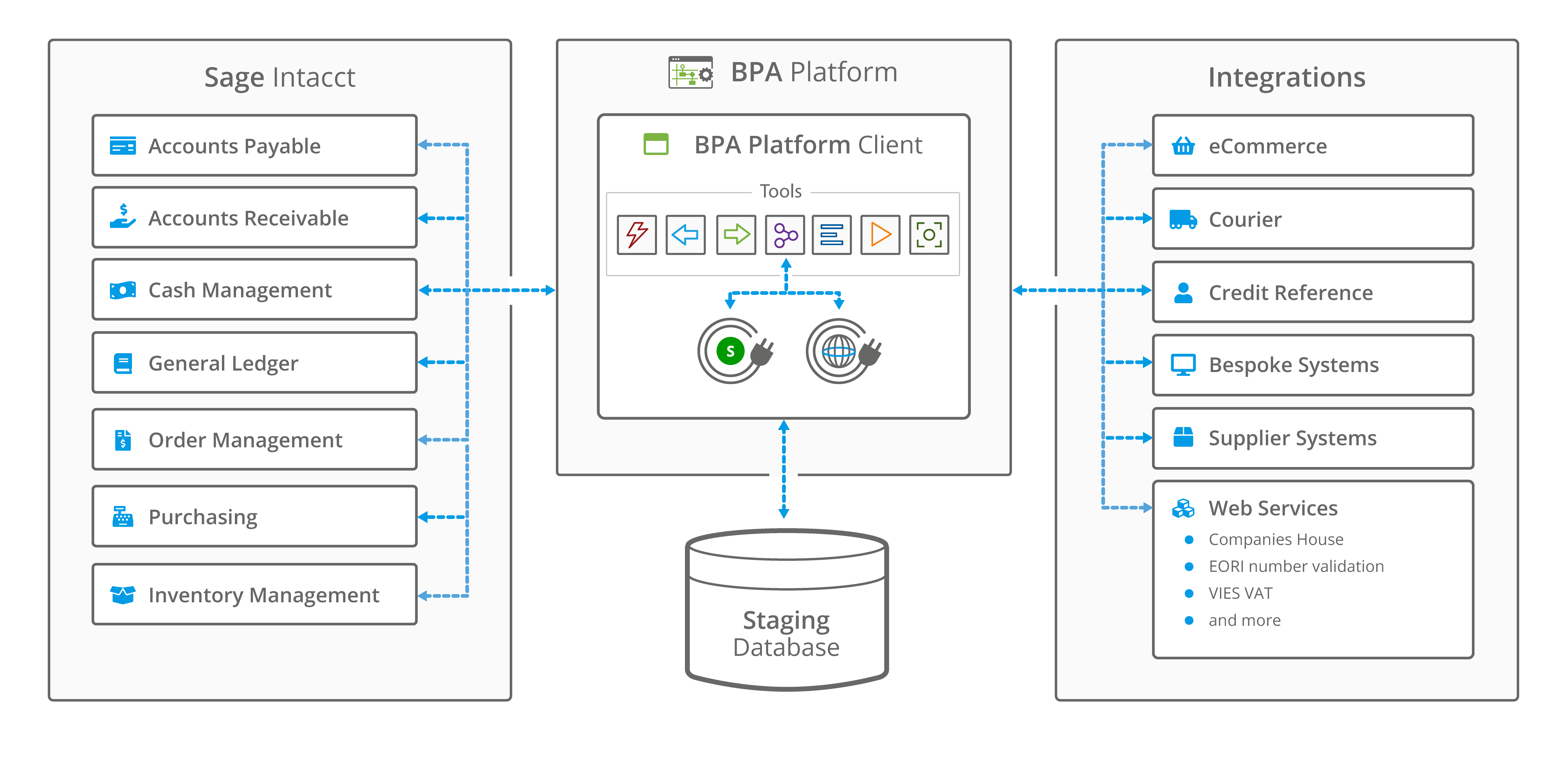

Explore advanced features and modules offered by Sage Intacct, such as multi-entity management, project accounting, and revenue recognition, to address specific business needs and requirements. Identify opportunities to integrate Sage Intacct with other business applications, such as CRM systems, ERP solutions, and payroll platforms, to create a seamless ecosystem of interconnected tools and data.

Optimizing Reporting Capabilities to Gain Actionable Insights:

Utilize Sage Intacct’s robust reporting and analytics capabilities to generate customizable financial reports, dashboards, and KPIs that provide real-time visibility into key performance metrics. Leverage drill-down functionality and interactive visualizations to analyze trends, identify outliers, and uncover insights that drive informed decision-making and strategic planning.

Utilizing Automation Tools to Streamline Processes and Increase Efficiency:

Take advantage of Sage Intacct’s automation capabilities, such as automated workflows, recurring journal entries, and scheduled report generation, to streamline routine tasks and reduce manual intervention. Implement approval workflows and controls to ensure compliance with internal policies, regulatory requirements, and industry standards while improving efficiency and accountability.

Continuing to Explore New Features and Updates from Sage Intacct:

Stay informed about new features, enhancements, and updates released by Sage Intacct through regular communication channels, user forums, and training resources. Participate in user groups, webinars, and conferences to network with other Sage Intacct users, share best practices, and learn about innovative ways to leverage the platform. By maximizing the value of Sage Intacct, organizations can unlock new opportunities for growth, innovation, and competitive advantage.

By embracing continuous improvement and innovation, organizations can stay ahead of evolving business trends, respond to changing market dynamics, and drive sustainable success in the digital age. In the subsequent sections, we will explore strategies for ensuring compliance and data security, measuring success and return on investment (ROI), and embracing the future of accounting with Sage Intacct.

Ensuring Compliance and Data Security

Ensuring compliance and data security is paramount when utilizing Sage Intacct for cloud-based accounting. Organizations must adhere to regulatory requirements, protect sensitive financial data, and mitigate risks associated with cyber threats and data breaches. By implementing robust security measures and adhering to best practices, organizations can maintain trust, integrity, and confidentiality in their financial operations.

Understanding Regulatory Requirements and Compliance Standards:

Stay informed about regulatory requirements and compliance standards relevant to your industry and geographic location, such as GAAP, IFRS, SOX, GDPR, and HIPAA.

Conduct regular audits and assessments to ensure compliance with internal policies, regulatory guidelines, and industry-specific regulations governing financial reporting, data privacy, and information security.

Implementing Robust Security Measures to Protect Sensitive Financial Data:

Implement multi-layered security controls, including encryption, access controls, and user authentication mechanisms, to protect sensitive financial data stored in Sage Intacct. Utilize role-based access controls (RBAC) to restrict access to confidential information and ensure that users have appropriate permissions based on their roles and responsibilities within the organization.

Conducting Regular Audits and Assessments to Maintain Compliance:

Conduct periodic security assessments, vulnerability scans, and penetration tests to identify and remediate security vulnerabilities and weaknesses in Sage Intacct and associated systems. Establish audit trails and logging mechanisms to monitor user activities, system access, and changes to financial data, ensuring accountability and transparency in financial operations.

Staying Informed about Industry Best Practices and Emerging Threats:

Stay abreast of industry best practices, standards, and frameworks for information security, such as ISO 27001, NIST Cybersecurity Framework, and CIS Controls, to guide security initiatives and risk management efforts. Stay vigilant about emerging threats, cyber attack trends, and security vulnerabilities affecting cloud-based accounting platforms, and take proactive measures to mitigate risks and protect against potential threats.

By prioritizing compliance and data security, organizations can mitigate risks, safeguard sensitive financial information, and maintain trust and confidence in their accounting practices. A proactive approach to security and compliance ensures that organizations remain resilient and responsive to evolving regulatory requirements and cyber threats, enabling them to focus on driving business growth and innovation with confidence. In the subsequent sections, we will explore strategies for measuring success and return on investment (ROI) and embracing the future of accounting with Sage Intacct.

Measuring Success and ROI

Measuring success and return on investment (ROI) is essential for evaluating the effectiveness of Sage Intacct implementation and ensuring that organizations derive maximum value from their investment in cloud-based accounting. By establishing key performance indicators (KPIs) and tracking metrics related to efficiency, productivity, and financial performance, organizations can assess the impact of Sage Intacct on their operations and strategic objectives.

Establishing Key Performance Indicators (KPIs) to Measure Success:

Define measurable KPIs aligned with organizational goals and objectives, such as time savings, process efficiency, error reduction, and financial accuracy. Identify specific metrics related to user adoption, system utilization, and satisfaction levels to gauge the overall success of the Sage Intacct implementation.

Tracking Metrics such as Time Savings, Productivity Gains, and Error Reduction:

Measure the time savings and productivity gains achieved through automation, streamlined workflows, and enhanced reporting capabilities provided by Sage Intacct. Track metrics related to error reduction, data accuracy, and reconciliation efficiencies to quantify improvements in financial operations and compliance processes.

Conducting Regular Reviews and Assessments to Evaluate ROI:

Conduct periodic reviews and assessments to evaluate the ROI of Sage Intacct implementation and identify opportunities for optimization and improvement. Compare actual performance metrics against predefined benchmarks and targets to assess the effectiveness of the Sage Intacct solution in delivering tangible business value.

Identifying Areas for Continuous Improvement and Optimization:

Analyze performance data and user feedback to identify areas for optimization, enhancement, and further investment in Sage Intacct. Collaborate with stakeholders, including finance teams, executives, and end-users, to prioritize initiatives and allocate resources effectively based on ROI and strategic alignment.

By measuring success and ROI, organizations can demonstrate the tangible benefits of Sage Intacct implementation, justify ongoing investments in cloud-based accounting, and drive continuous improvement in financial management practices. A data-driven approach to measuring success enables organizations to make informed decisions, optimize resources, and maximize the long-term value of their investment in Sage Intacct. In the subsequent sections, we will explore strategies for embracing the future of accounting with Sage Intacct and staying at the forefront of innovation in financial management.

Conclusion: Embracing the Future of Accounting with Sage Intacct

As organizations navigate the complexities of modern business environments, the transition to cloud-based accounting with Sage Intacct represents a strategic imperative for driving innovation, efficiency, and growth. By embracing the full capabilities of Sage Intacct and leveraging its advanced features, organizations can transform their financial management practices, streamline operations, and unlock new opportunities for success.

Recap of the Benefits of Sage Intacct:

Reflect on the key benefits and advantages of Sage Intacct, including cost-effectiveness, enhanced accessibility, scalability, advanced security, and real-time collaboration. Highlight the transformative impact of Sage Intacct in optimizing accounting processes, improving data accuracy, and driving informed decision-making.

Encouragement to Embrace Innovation and Digital Transformation:

Encourage organizations to embrace innovation and digital transformation in their financial management practices, recognizing the potential for cloud-based accounting solutions to revolutionize traditional approaches.

Emphasize the importance of agility, adaptability, and continuous improvement in staying ahead of market trends and evolving business requirements.

Call to Action to Explore the Possibilities of Sage Intacct:

Inspire organizations to explore the full potential of Sage Intacct and leverage its advanced features, customization options, and integration capabilities to achieve their strategic objectives. Encourage organizations to take proactive steps to maximize the value of Sage Intacct, including ongoing training, optimization, and collaboration with Sage Intacct experts and user communities.

By embracing the future of accounting with Sage Intacct, organizations can position themselves for sustained success in an increasingly competitive and dynamic business landscape. By leveraging Sage Intacct’s cloud-based platform, organizations can drive innovation, streamline operations, and achieve greater agility and resilience in the face of change. As organizations embark on this transformative journey, the possibilities are limitless, and the potential for growth and success is boundless.